utah non food tax rate

West Mountain UT Sales Tax Rate. Based off of Utahs current sales tax rate on unprepared food of 175 Berni probably pays around 1925 a month in sales tax on food.

For more information see httpstaxutahgovsalesnon-nexus Impacted Comm.

. Source their sales based on the ZIP 4 of the customers address. If Utah voters had their way Utah would join those states and stop charging a sales tax on food purchases. According to the US.

West Valley City UT Sales Tax Rate. Tax years prior to 2008. January 1 2018 December 31 2021.

Depending on local jurisdictions the total tax rate can be as high as 87. But a bagel sold with utensils is considered. 91 rows General Information.

Like lotteries state taxes on food amount to a tax on the poor. Utah lawmaker Rosemary Lesser is leading the cause to eliminate sales tax from food purchases. West Point UT Sales Tax Rate.

The Utah UT state sales tax rate is 47. Judy Weeks Rohner R-West Valley City talks about HB165 and HB203 which both aim to eliminate the states sales tax on food during a press conference outside of the Capitol in. In the state of Utah the foods are subject to local taxes.

Amount of purchases except grocery food subject to use tax 2. Polling on the 2019 proposal to increase the sales tax on food showed. Your sales tax rate depends on where you are doing business in Utah and the type of business you are conducting.

PLEASE CALL OR EMAIL Jared Rezendes jrezendesutahgov 385-499-0553 David Swan dswandswanutahgov 385. There are a total of 131 local tax jurisdictions across. NEED HELP LOGGING IN.

Utah specifies that prepared food is considered ready to eat or sold with utensils. Use tax rate decimal from Use Tax Rate Chart X. Wendover UT Sales Tax Rate.

Wellsville UT Sales Tax Rate. 274 rows Utah Sales Tax. The state provides a guidance page with plenty of examples on what is and what is not considered prepared food in Utah.

Thats about 409 in state sales taxes more a year equalling about 640 a. This means that depending on your location within Utah the total tax you pay can be significantly higher than the 485 state sales tax. Please email us your phone number and question if we do not answer the phone.

For example a bagel sold without utensils is considered a grocery item and taxed at the reduced 3 rate. Exact tax amount may vary for different items. Its a proposal that has not found traction within the Republican-controlled Utah Legislature and its leadership which this year prefers an.

The state of Utah currently taxes food at a rate of 175. With the rate restored to the full 485 Berni will likely spend around 5335 in state sales tax a month or about 3410 more. Businesses shipping goods into Utah can look up their customers tax rate by address or zip code at taputahgov.

The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668. January 1 2022 current. Tax rates are also available online at Utah Sales Use Tax Rates or you can contact the Tax Commission at 801-297-2200 or 1-800-662-4335.

Thirty-seven states do not charge any sales tax on food. West Bountiful UT Sales Tax Rate. Both food and food ingredients will be taxed at a reduced rate of 175.

Report and pay sales tax electronically on Taxpayer Access Point TAP at taputahgov using the template for form TC-62M Sales and Use Tax Return. Counties and cities can charge an additional local sales tax of up to 24 for a maximum possible combined sales tax of 835. Restaurants that sell grocery food in addition to prepared food may collect the lower 3 percent tax on their grocery food sales but ONLY IF those items are listed separately on the receipt or invoice.

Kristin Murphy Deseret News. West Haven UT Sales Tax Rate. The example above illustrates what kind of an impact allowing a family to spend the money differently would make.

In resort communities the Resort Exempt rate is the Combined Sales and Use tax rate minus the resort community tax. Although restaurants are not required to pay sales tax on food that they purchase for resale they are required to collect sales tax on food that they sell to their own customers. What is the non food tax in Utah.

January 1 2008 December 31 2017. 2022 Utah state sales tax. This includes the state rate of 175 local.

West Jordan UT Sales Tax Rate. There are only 13 states which tax food at any rate while 37 states have no sales tax on food at all. Average Sales Tax With Local.

The tax on food and food ingredients is 30 statewide. The state uses a flat tax rate of 495 for all income levels and the sales tax rate is 485. About a dozen Democratic Utah lawmakers and poverty advocates and one Republican huddled in the cold outside of the Utah Capitol on Tuesday to call for a repeal of the states food tax.

However in a bundled transaction which involves both food food ingredients and any other taxable items of tangible personal property the rate will be 465. This page lists the various sales use tax rates effective. We will get back to you ASAP.

Utah offers tax credits to reduce your tax liability including a taxpayer tax c Select Region. Sales and use tax rates vary throughout Utah. Utahs existing tax on food even at its lower rate of 175 is still wrong.

White City UT Sales Tax Rate. Restaurants must also collect a 1. Utah has a 485 statewide sales tax rate but also has 129 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 211 on top of the state tax.

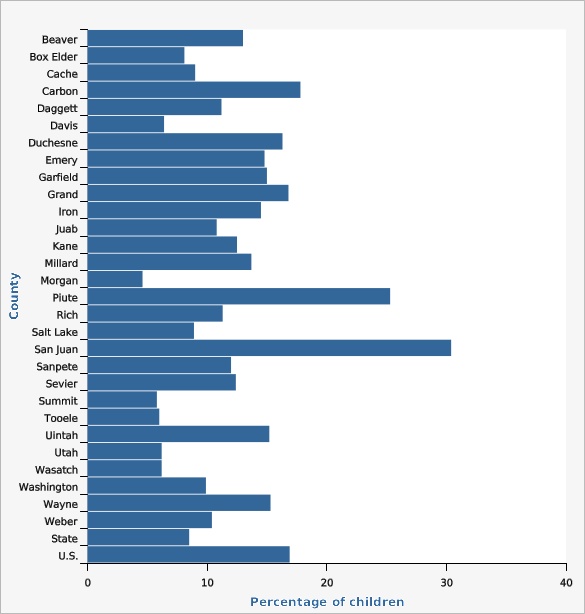

Department of Agriculture low-income families spend 36 of their income on food compared to 8 for high-income families. Utah has state sales tax of 485 and allows local governments to collect a local option sales tax of up to 335. Multiply line 1 by line 2 4.

Do restaurants pay tax on food. Use the Use Tax Rate List below to get the rate for the location where the merchandise was delivered stored used or consumed.

12 Facts About Bars And Booze In Utah That Might Surprise Or Confuse You Even If You Don T Drink Alcohol

Sales Tax By State How To Discount Your Sales Tax Bill Taxjar

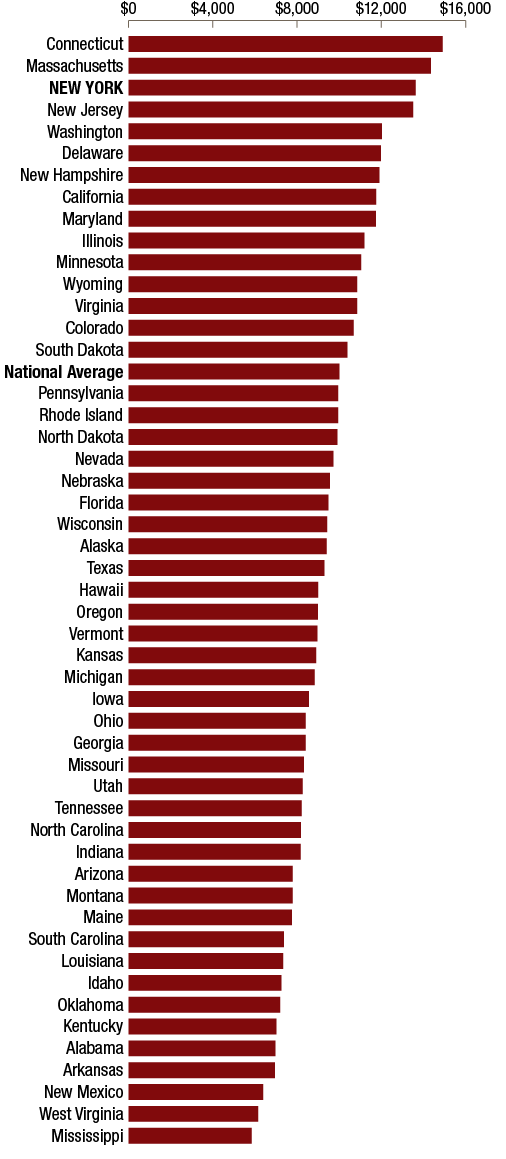

Virtually Every State Tax System Is Fundamentally Unfair Taking A Much Greater Share Of Income From Low And Middle Income Familie Higher Income State Tax Tax

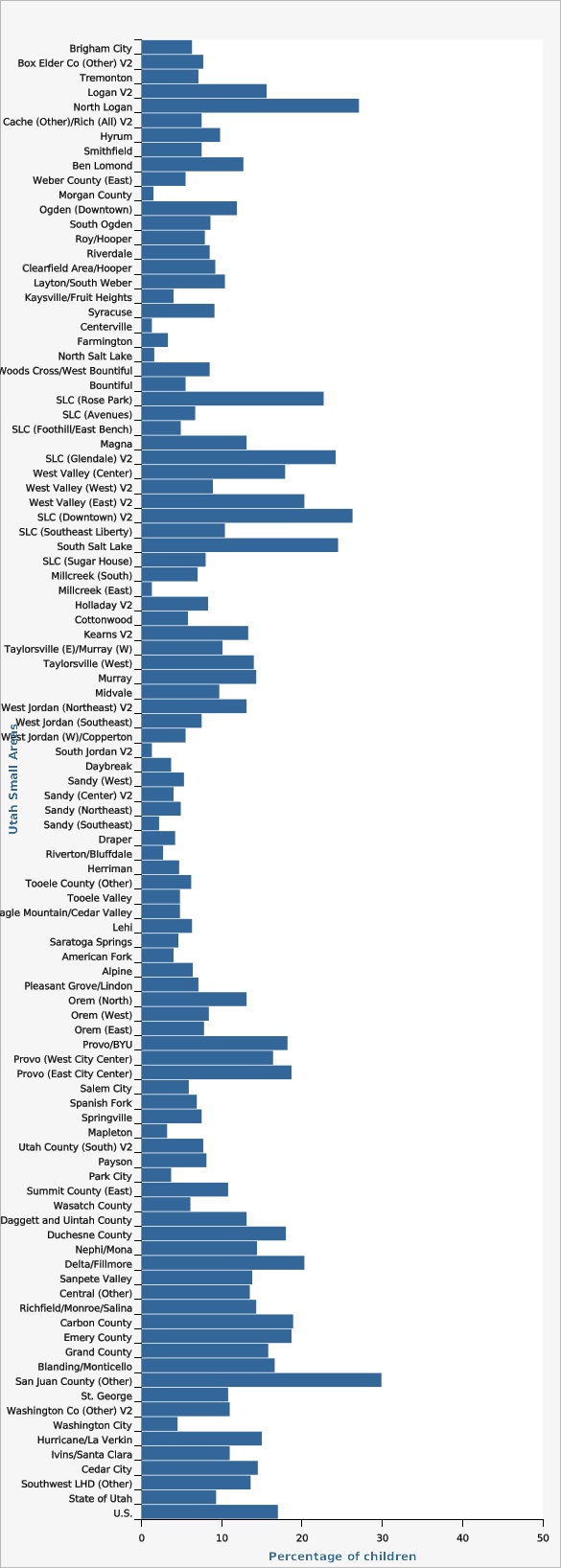

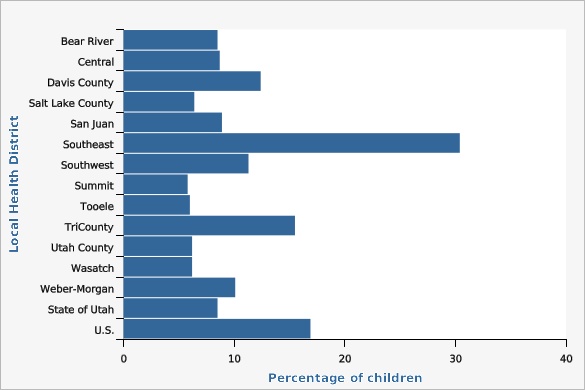

Ibis Ph Complete Health Indicator Report Utah Population Characteristics Poverty Children Age 17 And Under

Ibis Ph Complete Health Indicator Report Utah Population Characteristics Poverty Children Age 17 And Under

Ibis Ph Complete Health Indicator Report Utah Population Characteristics Poverty Children Age 17 And Under

Utah Retirement Tax Friendliness Smartasset

Sales Tax By State How To Discount Your Sales Tax Bill Taxjar

Utah Microcredentials Davis School District

New York S Balance Of Payments In The Federal Budget Federal Fiscal Year 2019 Office Of The New York State Comptroller